Inflation is on the rise. The world is at war. Governments are borrowing more money than ever. An increasing number of people are starting to realize that traditional investment strategies, such as debt instruments and pension funds, are actually losing them money. The old concept of ‘sit and earn,’ where wealth is confined to a stagnant wealth management advisory plan, does not work anymore. In this article, we explain in great detail the origins of the monetary problem, where the current situation is heading, and discuss solutions that you can implement to protect yourself in Reset Times.

The Eurodollar System: Unveiling the Need for New Collateral

The Eurodollar system emerged as a workaround to the limitations of the Bretton Woods monetary system established after World War II. Under the Bretton Woods System, gold was the basis for the U.S. dollar and other currencies were pegged to the U.S. dollar’s value. The problem was that in the wake of the war destruction, the sheer amount of money needed to rebuild Europe and initiate globalism was so large, that for the United States to service such demand would mean devaluing the dollar out of existence. This is known as Triffin’s Paradox, a dilemma where a country issuing the global reserve currency must supply the world with enough of its currency (in this case dollars), leading to potential economic imbalances and conflicts of interest.

In response, the City of London orchestrated the collaboration of private commercial banks in Europe to establish the Eurodollar system i.e. “ghost money system”. This system, rather than functioning like a traditional currency, operates more akin to a telecommunications network or a ledger. The Eurodollar system made money creation more efficient by combining the processes of creating money and facilitating transactions. In essence, it operates similarly to bookkeeping, where dollar claims are traded between banks and recorded like an accountant keeping track of who owes what to whom. In essence, it resembles bookkeeping, with banks trading dollar claims and maintaining records like an accountant keeping track of debts. For instance, if HSBC owes one million dollars to BNP Paribas, instead of an immediate repayment, BNP deducts the owed amount from a future transaction with HSBC—a simple ledger entry, just like in a blockchain. Banks were able to fuse the money creation function with the intermediation function. The problem of scalability remained. Bankers acceptances was the limiting factor.

U.S. treasuries became a preferred form of collateral for foreign lenders due to their high liquidity, providing a level of standardization that reduced the need for extensive knowledge about the other side of the trade. If a business needed a loan, all they had to do was show their U.S. Treasury, and a bank would give them the loan. These U.S. claims are also called “pristine collateral”. Contrast this with the old system based on unsecured transactions and the need for specialized knowledge of each business field. Now private commercial banks could use their U.S. dollar claims and treasuries to lend to other banks, forming a global interbank lending network. Banks worldwide, having extra cash, wanted to invest it. This led to the creation of a network where these banks could take in deposits denominated in foreign currencies, “swap” them into dollars, and then use these dollars for investments. In other words, the dealer banks were able to mass produce money outside of confines of Bretton Woods that is physical currency.

By 1971, the Eurodollar system had surpassed Bretton Woods, averting a financial collapse when the U.S. abandoned the gold standard. In 1981, a financialized economy, featuring fiat money and a 40-year interest rate downturn, emerged, necessitating exponential Eurodollar growth for stability. With its intricate interbank lending system, even a minor default could send ripples across the entire market. This is where the Repo (repurchase agreement) markets took center stage as lenders of last resort. Money market funds, flush with cash, extended loans to hedge funds, traders, and banks in exchange for collateral. While they preferred U.S. treasuries (considered the most pristine collateral), they also accepted other securities such as foreign debt or Mortgage-Backed Securities. Problems arose when the Repo market’s acceptable collateral shrank, as seen in 2008 when mortgage-backed securities ceased to be accepted. Naturally, with fewer options for accepted collateral, a shortage of pristine collateral ensued. The lack of overnight lending left overleveraged businesses unable to cover day-to-day operating expenses, triggering the 2008 Monetary Crisis that was basically a massive global dollar shortage due to freezing credit markets.

Ever since 2008, the Eurodollar market experienced a huge wakeup call, where banks stopped lending at the same scale as pre-2007. In all Eurodollar instrument charts, lending between 2008 and today has slowed dramatically, which severely contrasts pre-2007 and the exponential rise in foreign exchange derivatives. This shift challenges the notion of sustained easy money. The data reflects a notable change in the trend after 2008, suggesting that money and credit were not generated at the same accelerated rate as witnessed in the years leading up to the financial crisis.

The Eurodollar market’s growth relies on a continuous expansion of lending by banks. However, ever since 2007 many financial institutions stopped partaking in riskier collateral, only accepting pristine collateral such as U.S. treasuries. Without more lending, economic growth can only be sustained by massive government borrowing. The constant expansion of the U.S. debt market is crucial for preventing a collapse in the Eurodollar system due to lack of acceptable collateral.

To secure additional collateral, most of the time those in power have deliberately initiated endless wars. The latest iterations are conflicts in Ukraine and Israel. Each military involvement serves as a convenient pretext to issue more government bonds, increasing the overall debt in circulation. This influx of debt contributes to expanding the pool of high-quality collateral within the markets. Wars tend to be inflationary by nature and also offer an opportunity to acquire a nation’s gold and natural resources, which can later be used by global western banks as valuable collateral. We expect the next decade to be characterized by conflicts on multiple fronts, which will serve as an excuse for governments to pursue stealth quantitative easing.These wars have been and are kinetic. There is another way for banks to get additional collateral when push comes to shove during the crisis.

The Great Taking

The second maneuver is popularly referred to as the “Great Taking”, wherein central banks seek to seize and control various financial assets, bank deposits, stocks, bonds, and underlying properties of the public through engineered crises. Debt-ridden assets will be confiscated, similar to the events of the Great Depression. In the 1930s, when 9,000 U.S. banks failed, taking $7 billion in depositors’ assets with them, only the Federal Reserve-backed banks survived. However, the depositors’ debts in the banks that went out of business were not canceled; instead, they were consolidated into the Federal Reserve-backed banks and enforced.

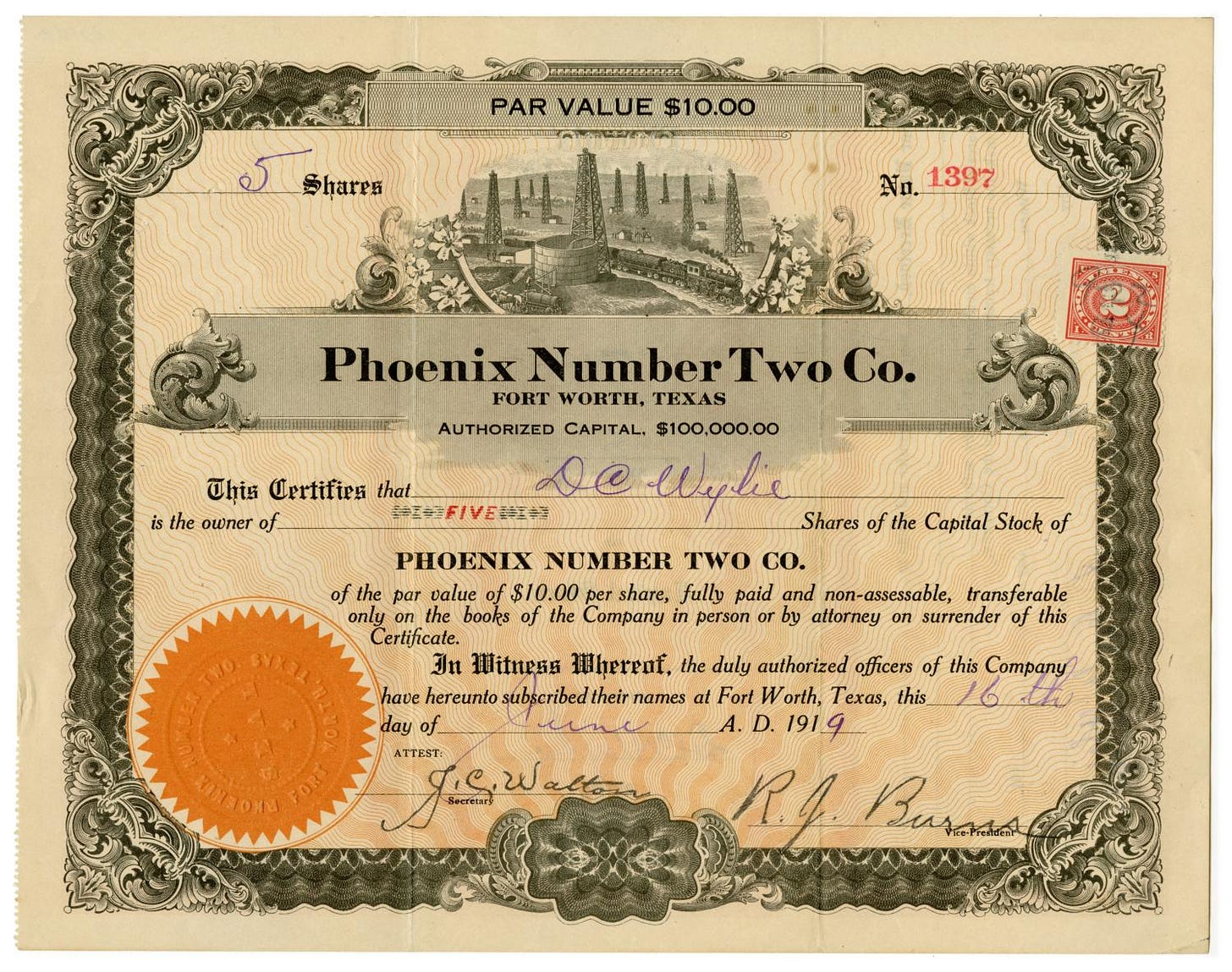

In the past, one used to receive physical stock certificates, tangible proof of ownership of shares. However, stock certificates have become obsolete, replaced by mere digital entries held with brokers. Despite the presence of SIPC insurance, which is limited, and FDIC coverage for insured deposits (up to $250,000), the legal claim over the securities with a broker is questionable. Just like with bail-ins, you do not have a legal claim over the securities that you own.

In the 1960s, the dematerialization trend phased out traditional paper securities, introducing an order book/ledger system. This transition led to a fundamental change in the understanding of ownership, moving towards entitlement. A subsequent development involved establishing a system where custodians and clearinghouses hold your shares; notably, these entities operate without regulation and lack collateral. Securities, held with an entitlement claim rather than outright ownership, are then pooled together as collateral for various investments, with a primary focus on derivatives. It’s important to note that this intentional setup could serve as a mechanism for a deliberate devaluation or a rug-pull of securities.

In the next phase of the Great Taking, the focus shifts towards control over food and health. The strategy is clear: by obtaining access to food and energy sources outside the conventional banking system, individuals can survive outside of the traditional banking system. This is why weaponized virtuous movements such as the environmentalists and health mandates are designed to remove people from their farmlands and forbid them access to natural medicines.

During the upcoming Hegelian engineered crises, individuals will be coerced under the pretext of safeguarding these systematically crucial financial institutions (SIFI), arguing that without such banks, restarting the economy would be impossible. Every financial bubble has brought in more repossessed wealth to the ultra-rich, taking the assets away from anyone not in the 0.1 percentile. It’s akin to a Monopoly game where all pieces and money are reclaimed by the bank, and then starting a new game. Beginning afresh, the narrative becomes one where they possess everything, and you have nothing—would you like to borrow something?

This scenario mirrors what the central bank digital currency (CBDC) represents. It becomes extremely challenging for people to resist using it, given the essential nature of basic needs. Imagine an app available for download—the cavalry coming to the rescue. By downloading this app, you can load your phone with digital currency, enabling you to purchase necessities like water. However, each usage entails borrowing money from the system, creating a subtle but impactful dependency. They may even provide a “free” initial CBDC offering, which will be a Central Bank loan disguised as Universal Basic Income.

So, what are the solutions?

For starters, individuals in the stock and crypto markets should significantly deleverage. In many cases, it is more prudent to sell digital assets and invest in tangible wealth, such as real estate, land, precious metals, and portable art, rather than keeping money in a bank, stocks or NFTs that one does not own. Plausible scenarios, such as international power outages or a cybersecurity hack affecting financial institutions, could wipe out one’s trading portfolio, assuming that a margin call doesn’t do it for them.

However, this does not mean to complete disregard for traditional investments. In fact, contrary to public opinion, having a stake in U.S. dollars may be the best option from all liquid vehicles. The notion of BRICS nations trading energy outside the US dollar is frequently discussed, but the success of dedollarization initiatives may be overemphasized. While there is a desire to dedollarize, the ability to achieve this seamlessly is often exaggerated. Dedollarization will happen out of need, not desire. Historical trends show that the dollar tends to strengthen during crises because of the global dollar shortage (such as in 2008 and during the Covid pandemic) and then weaken afterward. However, this is not necessarily indicative of the end of dollar hegemony.

In times of crisis, such as the events of 2008 and the Covid pandemic, the US dollar typically experiences an initial rise followed by a subsequent fall post-crisis. This could easily happen again in the near future. However, it is crucial to understand that this does not mean the end of dollar hegemony; instead, it reflects that the existing system continues to work. During periods of dollar weakness, countries, corporations, and individuals often choose to issue more dollar debt instead of paying it down, driven by the high demand for dollars. For the collapse of dollar hegemony to occur, countries would need to seize the opportunity presented by the weakened dollar to pay down their dollar debt, which is a very rare occurrence nowadays. Even if dedollarization were to take place, it would be a gradual process rather than an overnight phenomenon.

This does not mean you go all into U.S. equities or dollarized assets. It does mean however, that when it comes to a cash position, the dollar has outperformed most other currencies in both the Global Monetary Crisis of 2008, and the Covid Pandemic in 2020.

Similarly, the bond markets are expected to function for at least the next three years, primarily because if the United States defaults on its debt, the last concern would be the treasury market. Such a default would signify the collapse of the entire Eurodollar market and the global economy. One of our suggestion is to consider floating rate notes (FRNs), which are bonds with an interest rate that is not fixed but adjusts periodically based on the prevailing interest rate. If the premise is that there will be more debt issuance to prop up the current system, it is logical to assume that interest rates will rise as the value of government debt falls unless a demand destroying event occurs and causes panic buying of Treasuries and their global equivalents resulting in opposite short term outcome. However, it’s crucial to note that this strategy is effective only in the short term, especially before entering a hyperinflationary depression, as the FRN rate may struggle to keep pace with higher inflation rates.

When it comes to the underlying solution, any investment that makes people less dependent on the government and thrive in an off-grid environment is a safe bet. Stock up on non-perishables, buy real estate with land and a water source, have home energy storage system designed for the whole house and focus on general self-sufficiency for the best long-term results. Since accomplishing all of this alone is impossible, one will need to implement loan contracts for a supply of goods or services over a fixed period and build a community based on the exchange of goods rather than fiat monetary value. An example would be investing in your neighbor’s upstarting chicken coop; instead of asking for a monetary return, negotiate a supply of eggs over five years. Similarly, investing in crops, plants, children’s education, or tools and knowledge fits the definition of an investment—what you invest will yield more in the future.

Finally, whatever you own should be moved off your balance sheets, structured out of your own name, and preferably tied into a kinetic tax structure. The first thing that governments have access to is their own tax reporting data, and no one wants to have their properties showing up in databases in their own name. Asset protection solutions allow you to continue operating in the digital economy without having to give up your privacy or security.

In conclusion, the Eurodollar ghost money system requires more collateral, and the tokenized economy through future Central Bank Digital Currencies addresses this concern. Many pundits argue for complete disconnection from the grid, avoiding all involvement with future technocratic systems. At Coins Without Borders, we believe this is not a sustainable long-term solution because certain services and products cannot be handmade, making it an impractical way to live. Our goal is to harness the best of both worlds – we guide you on how to maintain collaboration with financial institutions while embracing an off-grid lifestyle, securing personal freedom for you and your family.

For more on wealth management strategies and actually implementing them, feel free to contact us at info@coinswithoutborders.com