I recently stumbled upon a heated discussion among Monero community members regarding Bitcoin. They couldn’t comprehend why Michael Saylor kept promoting this “ponzi scheme” and fully supported Jamie Dimon’s comparison of Bitcoin to a “pet rock.” They argued that, with the hard fork of XMR, Bitcoin essentially had little to no use case. After all, Satoshi’s promise of ending banks and the dollar’s global hegemony seemed to have lost itself in the headwind, with stablecoins dominating the vast majority of blockchain transactions. They couldn’t believe that the SEC labeled Bitcoin as a commodity and doubted the intentions of major financial institutions embracing this “anti-bank” crypto with the launch of ETFs.

To this day, I still do not believe that Bitcoin was magically “engineered” by one cryptographer with pure intentions for the world to debank themselves. In fact, it is common knowledge that “Satoshi Nakamoto” did not invent Bitcoin; rather, he wrote the whitepaper for Bitcoin. Since there were only 400 cryptographers at the time, it is very plausible that the intelligence services know very well who created this “digital store of value.” Previously, I underlined Dan Kaminsky’s discoveries and Benjamin Wallace’s speculation on Nakamoto’s potential ties to British and American intelligence agencies. These claims do leave a large unanswered question: if Bitcoin were invented by state-sponsored actors, then what was the problem it was trying to solve?

Returning to the backdrop of Bitcoin’s launch, the year 2008 marked one of the most significant monetary crises the world had witnessed in over seven decades. In my article, “Wealth Management in Reset Times,” I delve into the notion that this crisis wasn’t merely the bursting of a “housing bubble,” as portrayed by mainstream media; its repercussions were far-reaching. It teetered on the brink of unraveling the entire Eurodollar system, a framework that had propelled global prosperity since the 1960s. Then, out of the blue, Bitcoin emerged, boldly pledging to “destroy central banks” and “eliminate the need for dollars.” What many failed to grasp at that moment was the intricate connection between Bitcoin, and frankly all cryptocurrencies, with conventional banking. Far from being a disruptive force seeking to obliterate the banking system, they emerged as tools to refine and fortify the existing Eurodollar structure.

The once fervent belief that “Bitcoin will triumph because the dollar is doomed” touted by Bitcoin maximalists turned out to be nothing more than a mirage. In reality, it has facilitated the creation of more Eurodollars, operating in stark contradiction to the prophecy. To underline this point, let’s examine the best-known case of Bitcoin adoption- El Salvador’s decision to embrace Bitcoin as legal tender in June 2021. At that time, the country was grappling with a plethora of issues—decaying infrastructure, rampant crime making it the murder capital of the world, and President Bukele striving to bring order. “In the short term, this will generate jobs and help provide financial inclusion to thousands outside the formal economy,” remarked Bukele in a video showcased at the Bitcoin 2021 conference in Miami.

However, a less-publicized event occurred three months prior to Bukele’s announcement. In March 2021, El Salvador officials found themselves in Washington D.C., imploring the IMF for a billion-dollar bailout, a colossal sum for this small nation. The reason behind this plea was straightforward- they did not have enough dollars, a major issue if your entire economy runs on the dollar. The introduction of a dollarized economy in 2001 had initially brought prosperity, with offshore banks generously lending to businesses left and right. However, the 2008 crisis reversed this scenario, leading to a decade of economic hardships for numerous Latin American countries, including El Salvador. Dollar reserves dwindled over the years, and in 2019-2020, the country even halted reporting its reserves for an entire year. When reporting resumed, the reserves had fallen below the IMF’s “predetermined short-term net drains,” essentially the Eurodollars that El Salvador owed to other countries.

Faced with an IMF refusal of the loan request, El Salvador was on the brink of potential economic collapse, similar to Argentina during the “Coralito” debacle in 2001. In a surprising turn, President Bukele sought an innovative solution to replenish the draining dollar reserves—using Bitcoin as collateral. Similar to collateralizing a U.S. treasury, he showcased an innovative approach to the world’s indebted nations, demonstrating how cryptocurrencies could be used to access Eurodollars. The myth that this move was a challenge to the world’s financial hegemony is dispelled by the fact that Bukele, unlike the Presidents of Haiti, Tanzania, or Burundi, all who mysteriously died in 2021, has not faced assassination or a U.S. backed coup. I invite curious readers to investigate the common denominator preceding the deaths of these other leaders.

As explored in my previous article, for the past 70 years, the vast majority of money is created out of thin air by private banks in the form of credit. This exponential growth persisted until August of 2007, and since then, bank balance sheets have maintained a sideways trajectory, resulting in a dollar shortage. Contrary to the commonly accepted narrative that the Federal Reserve’s monetary policy influences the amount of dollars in circulation (popularized through memes like the Fed going “brr”), it’s crucial to recognize that money is, in fact, created by private banks, not the U.S. Central Bank.

Operating under the premise that banks essentially create money out of thin air, a closer look at the volume of loans granted by banks reveals a significant contraction, especially in the aftermath of the 2008 crisis. Faced with the risks associated with lending to potentially unstable businesses, instead of fortifying their lending criteria, banks shifted their focus to the less risky yet more lucrative financial sector. Why extend loans to businesses when more profits could be made trading derivatives? The consequence? A dire shortage of Eurodollars.

In the contemporary landscape of our financialized economy, a pressing question emerges – how can we generate more Eurodollars if banks have significantly curtailed lending?

When an individual borrows from a bank, they typically provide collateral, such as a car. However, imagine obtaining a loan against the same collateral while the car is lent to a friend. Instead of pledging the physical object, one offers a claim on the car, represented by an IOU. While traditional banking might dismiss the IOU as unreliable for the average person, in modern banking, this is precisely how 98% of money is created.

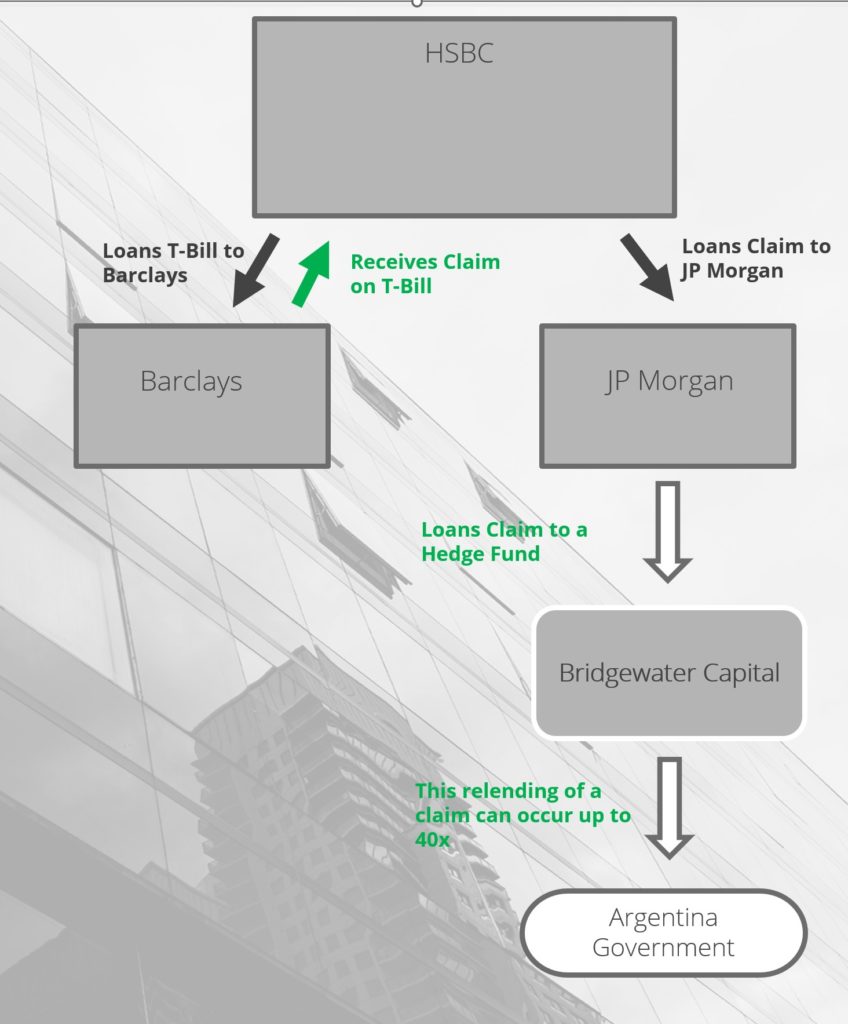

Consider the scenario where HSBC lends a treasury note to Barclays. HSBC holds only a claim on that note—an IOU where Barclays promises to return the Treasury along with interest. The next day, JP Morgan approaches HSBC seeking to also borrow a treasury note. While HSBC no longer physically possesses the note, having lent it out the previous day, it can still inform JP Morgan, “I don’t have the actual Treasury, but I hold a claim on it.” In the Eurodollar realm, this “claim” serves as acceptable collateral, which explains why JP Morgan readily accepts it. JP Morgan can then proceed to re-lend this claim on a Treasury to another financial institution, such as a hedge fund.

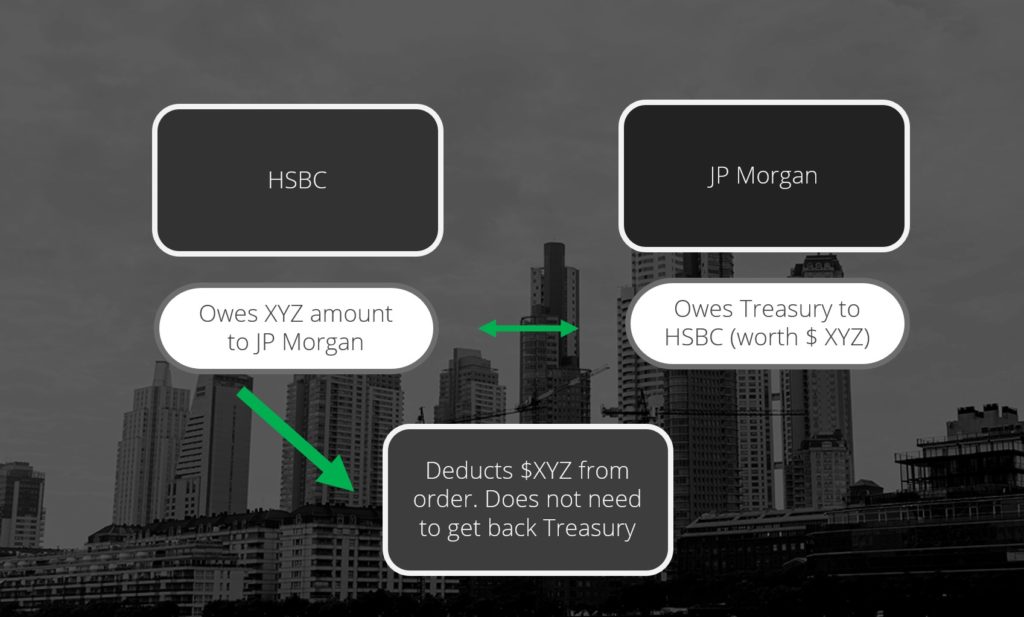

This concept closely resembles a blockchain ledger. Consider the scenario where JP Morgan wishes to settle the loan initially borrowed from HSBC. Instead of returning a physical Treasury, JP Morgan deducts the owed amount from a future transaction where HSBC is the debtor. Suddenly, we find ourselves in an inter-bank lending network, where none of the actors realistically expect to get back their original Treasury bill. All that’s required is to settle the accounts, hence why banks are essentially glorified bookkeepers.

This process of relending claims on dollars can occur sometimes up to 40 times, which in banking terms is called “rehypothecation”. For the average person, this resembles a form of degenerate gambling, akin to the risky crypto traders who leverage 40x on margin. Now, picture the fate of the crypto trader whose collateral, initially posted in margin, loses value—or worse, is no longer accepted. In such a scenario, they must scramble to provide different, more secure collateral, or face the risk of losing their entire investment in a margin call.

In the broader financial landscape, numerous businesses adopt a similar strategy, borrowing against assets and utilizing the borrowed funds to cover employee salaries and operational expenses. Take, for instance, the FTX scandal, where the company leveraged their own FTT tokens to secure substantial loans, not only for payroll but also for the acquisition of other crypto businesses and tokens. This strategy thrived until the FTT tokens started losing value and were eventually no longer accepted as collateral by lending institutions. Sam Bankman Fried didn’t have pristine collateral to bail his company out, and thus a multi-billion-dollar crypto exchange crumbled in less than 48 hours.

This mirrors the events of 2008 when financial institutions like Lehman Brothers found themselves in a bind as their Mortgage-Backed Securities (MBS) ceased to be accepted in the Repo market. Suddenly, highly indebted businesses faced a cash crunch, unable to secure overnight funds for operational expenses – similar to FTX. The only way out was to provide better collateral, such as treasuries (“pristine collateral”), or risk being cut off from borrowing altogether.

This is precisely why we experienced a Monetary Crisis—there was a shortage of “pristine” collateral. Almost miraculously, Bitcoin emerged from the 2008 crash, touted as the best “store of value” on the market.

The point is, for the Eurodollar scheme to keep growing, it constantly requires new collateral to generate loans, preferably of the “pristine” variety. One method to acquire it is through wars—plundering new resources, such as Iraqi oil fields or Ukrainian gold reserves, serves as recent examples. Wars also facilitate new debt issuance, i.e., government bonds, considered the pinnacle of collateral in this complex financial ecosystem.

Bitcoin and cryptocurrencies, in general, introduce a fresh perspective on flexible collateral. The first notable aspect is their public nature, allowing for complete transparency in tracking each coin and transaction. This transparency enables financial institutions to anticipate collateral shortages, providing a level of preparedness in case certain borrowers show signs of instability.

Secondly, the widely debated concept of Bitcoin as a “store of value” is a prevalent topic in the blockchain community, though debunked by Caitlyn Long, who introduced the term “paper Bitcoins.” Following Binance’s initiation of Bitcoin futures and options trading in late 2017, the assumption that “only 21 million Bitcoin” exists is proven false. These contracts essentially represent promises from intermediaries, such as exchanges, to deliver actual Bitcoin. Without holding the private keys, one doesn’t actually possess the Bitcoin but rather a claim to it—an IOU. Does this ring a bell from the rehypothecated Treasury Bills?

Consequently, significant institutional players like JP Morgan can short Bitcoin without holding a substantial supply of the underlying asset. The volume of Bitcoin derivatives surpasses the actual Bitcoin available in the market, a trend likely to intensify with the recent approval of a Bitcoin ETF by the SEC. The objective is to generate more Eurodollars through the issuance of synthetic Bitcoin.

In conclusion, Bitcoin and other cryptocurrencies provide a solution to the Eurodollar system’s collateral shortage. When figures like Jamie Dimon dismiss cryptos as a “complete side show” or liken them to “pet rocks,” it sounds more like the pot calling the kettle black, considering blockchain ledgers directly challenge the banking business model—just another system of ledgers. Jamie seems to suggest that JP Morgan will only support cryptocurrencies issued and controlled by the bank, similar to today’s private stablecoin companies such as Tether or USDC.

To track interbank settlements and ensure each bank’s balance sheet matches, stablecoins are likely to evolve into the de facto CBDC (Central Bank Digital Currency) for the United States and possibly the world. The lines between the private and public sectors are already blurred, with Tether recently involving the CIA and FBI in blacklisting certain addresses. However, the challenge for banks lies in the 1 to 1 ratio of reserves required by stablecoins, contrary to the current fractional reserve banking model. The future may involve synthetic deposit security tokens, akin to paper Bitcoin, allowing banks to rehypothecate customer deposits while ensuring transparent tracking. For those intrigued by this topic, I highly recommend exploring DTCC’s partnership with R3 to develop digital versions of T-Bills, aiming to decrease settlement failure rates.

Is the Bitcoin ETF good or bad news? While the obvious answer for the average investor may be positive due to an influx of institutional money, it’s crucial to consider the potential manipulation, similar to what has occurred in the gold market for over a decade. Personally, I believe Bitcoin could reach up to $1 million per coin, but two possible problems linger: will the average investor be able to cash out, or will the market be restricted to accredited investors only via digital identities and centralized exchanges? And secondly, how much purchasing power will that million dollars afford you? Perhaps not much more than what one Bitcoin can buy you today…